Chances are, we could all work on saving more money. And January is a great time to get started. More than 30% of people planned to make a financial New Year’s resolution last year, according to a survey by Fidelity Investments. Of those respondents, 48% said their main priority is to save more. Whether it’s paying off your mortgage, getting out of student loan debt, or working toward giving yourself a much-deserved vacation, we found a pretty darn manageable way to save a significant amount of dough this year. It’s called the 52-Week Money Challenge.

What is the 52 Week Money Challenge?

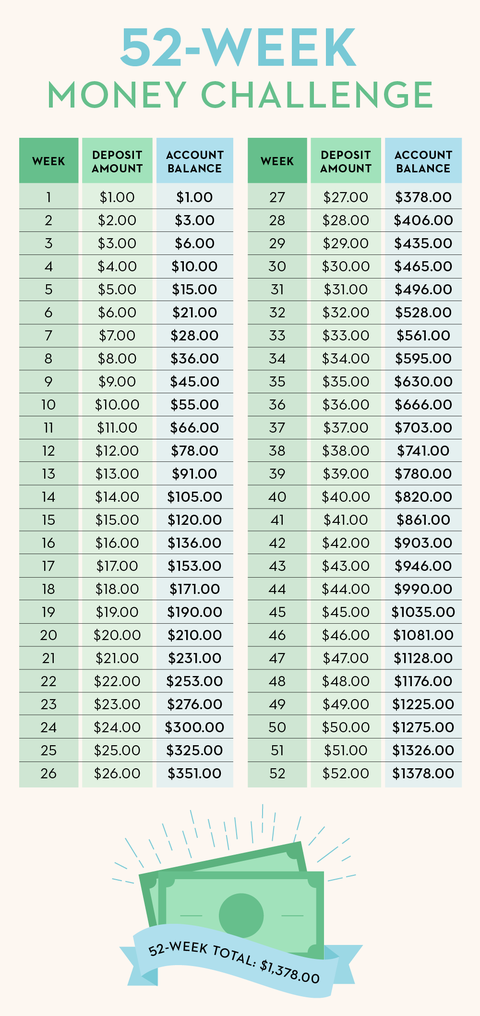

It basically tasks you with saving money incrementally. During week one, put $1 in an online savings account. Week two, sock away $2 and so on until week 52.

“Open up a totally different savings account for this goal,” says Berna Anat, who paid off $50,000 in student loan and credit card debt in January 2018. Now, she helps others achieve their financial goals on Instagram. “If you can, open it up in a different bank altogether. Whoever invented ‘out of sight, out of mind’ was on point here. The less likely you are to see this account on a regular basis, the less likely you’ll be tempted to dip in and spend it.”

Use this chart to see how your entire year will play out:

Another option is to do the challenge in reverse, so you start with $52 on week one, and go down to $51 in week two. By December 31, you should can add just $1 to your savings and reach the same total.

How much money will you have at the end of the 52-week challenge?

If you follow this program for one year, you’ll have $1,378 by the end of it. You don’t have to stop there, though. If you’re willing to save even more, consider upping the week-by-week increase.

Umm, why should I do this to myself?

Aside from becoming more economically responsible, it will probably give you a major ego boost to become so good at saving $$. Plus, you’ll earn bragging rights on Instagram, like these folks:

How can I save THAT much money?

We could go on and on about the tiny adjustments that can lead to serious savings, but our go-tos involve falling in love with DIY and cooking at home. And let your friends know about your decision. Even though meeting up for dinner or drinks might be part of your typical social routine, Anat says bringing them in on your goal will give you more support and open up new conversations.

Another effective way to hack the system is to check off the dollar amounts in any order you want. If it’s more feasible to drop $52 before next December, do it. Keep yourself accountable by setting reminders in your calendar to deposit your savings at the same time each week. If your bank lets you nickname your account, follow Anat’s method of giving it a hilarious title, like the “Beyoncé World Tour Fund.”

And be sure to reward yourself throughout the year. “Set up celebration checkpoints along the way!” says Anat. “We often forget to make habits fun for ourselves. For example, if you make it to the 30th of the month and you’ve done all four deposits that month, treat yourself to something you love that doesn’t cost money — you get to binge-watch a YouTube series, or turn off your phone guilt-free for a night and take a loooong bath.”

Anat also recommends grabbing an accountability partner, or someone who can participate in the challenge with you. They’ll serve as your support system and sounding board whenever budgeting and saving gets tough.

Is this the same thing as the $5 challenge?

No. Another online challenge out there involves saving all the $5 bills you encounter. And that’s not a bad idea! So is the 52-week saving challenge from the blog Gathering Dreams, which will help you save $5,000 by the end of the year.

Not sure if you want to commit to a year-long program? For the month of January, Anat partnered with Evernote to host the #EverBetterChallenge. Her goal is to save $219 to kick off 2019. You can follow along as she shares tips and lessons on Instagram.